CALCULATORS

KELLY CRITERION CALCULATOR

Calculate the optimal bet size for a selection and manage your bankroll like a pro with the Kelly Criterion Calculator.

This is just one of a range of free betting calculators we provide at ProfitDuel to help you maximize your profits online.

FREE GUIDE

MAKE MONEY KELLY BETTING (+ 5 BONUS STRATEGIES)

Join the top 3% of bettors and discover the 6 best strategies for gaining an edge over the Sportsbook this year (curated by our team of experts).

Open fast find

Close fast find

START YOUR PROFITDUEL TRIAL

Start your ProfitDuel trial today and we'll walk you through locking in $100 profit with your first offer.

1. What is a Kelly Criterion Calculator?

A Kelly Criterion Calculator tells you, in one step, what percentage of your bankroll to stake by combining the bet’s odds with your estimated win probability; this maximizes long-term growth while containing risk.

- Requires only bankroll, decimal odds, and win-rate input.

- Outputs stake as a % and dollar amount.

- Full Kelly maximizes growth; fractional Kelly reduces risk.

- Useful for sports betting, blackjack, stocks, or crypto.

- Accuracy hinges on an honest win-probability estimate.

A Kelly Criterion Calculator is a tool, often used in betting, to help bettors calculate the optimal stake to wager on a selection. Also known as a Kelly Calculator, the calculator's name was coined by its creator, John Kelly Jnr, in 1956.

John Kelly Jnr

The Kelly Calculator uses a number of inputs (explained in the next section) to calculate a suggested stake to bet on an event. In theory, using this tool over an extended period can help bettors reduce their risk of over-wagering and increase profits by improving bankroll management.

2. How do I Use a Kelly Criterion Calculator When Betting?

Using a Kelly Criterion Calculator to find a suggested stake is simpler than it sounds. All you need to do is follow five steps:

- Enter Your Bankroll: Your bankroll is the total amount of money you're willing to dedicate to bets at any one time. Think of it as your total betting budget.

- Enter the Odds: These are the odds of the selection you're planning to bet on, for example +110.

- Enter Your Win Percentage: This is the percentage of occasions that you've won on these odds. To work this out you'll need to have tracked your bet wins and losses, but if not, entering a rough estimate will work as a guideline.

- Enter Your Kelly Multiplier: This is how much of the calculator's recommended amount you want to wager (from 0 to 1). For example, if the calculator recommends wagering $50 but you're not as confident with this selection, you might opt to play it safe and enter a 0.5 Kelly Multiplier ($25) instead.

- View Your Recommended Amount: The calculator will display its suggested stake in $. From here it's up to you whether you place the wager at the recommended amount or decide against it.

3. Kelly Criterion Worked Example

Let's use an example to show how this could work in a real-life sports betting situation. The San Francisco 49ers are playing the Kansas City Chiefs. You want to bet on the 49ers to win but you want to work out the optimal stake to bet using the Kelly Calculator:

- Your total betting budget at this point in time is $300, so you enter that as your bankroll.

- The moneyline odds of the 49ers to beat the Chiefs on your chosen sportsbook are -110, so you enter that as your odds.

- Looking at your previous bets you know that in the past you've won on -110 odds 60% of the time. You enter 60% as your winning probability.

- You can now see the calculator has recommended a $80 stake for you. However, you want to play it safe on this occasion as the Chiefs are unpredictable, so you reduce the Kelly Multiplier to 0.5.

- You can see the final amount has been halved to $40. You're happy with this figure, so you go ahead and place $40 on the 49ers to beat the Chiefs through your sportsbook account.

Stake Strategy Comparison (Based on $300 Bankroll)

| Approach | Kelly Multiplier | Stake | Risk Level | When You’d Use It |

|---|---|---|---|---|

| Full Kelly | 1.0 | $80 | High | When you’re confident in your edge and want to maximize growth |

| Half Kelly | 0.5 | $40 | Moderate | When you're cautious or unsure of variance |

| Quarter Kelly | 0.25 | $20 | Low | When you’re testing or just building data |

| Flat Stake | — | $30 | Varies | When using fixed unit betting regardless of edge |

| No Bet | 0 | $0 | None | When you’re unsure or the odds don’t offer value |

4. Understanding how a Kelly Calculator Works: the Formula

You don't need to know the ins and outs of the Kelly Criterion formula to use it to help optimize your stakes - our calculator does that for you. But if you're keen to know how it works anyway, we've got you.

📈

What The Data Says

"A 2023 study showed that combining neural network models with advanced formulations of the Kelly Criterion in sports betting strategies led to an incredible 135.8% profit relative to the initial bankroll during the latter half of the 20/21 English Premier League season."

- arxiv

The Kelly Criterion uses a mathematical formula to calculate optimal stake sizes. It takes into account wager odds, total bankroll and bettor winning probability to offer a more statistically-backed, personally customized recommendation (rather than going simply off gut feeling or personal opinion).

Kelly Criterion Formula = (BP-Q) / B

B - The Decimal Odds -1

P - The probability of success

Q- The probability of failure (i.e 1-p)

In mathematical terms the Kelly Criterion formula = (BP-Q) / B. In this formula, B = the decimal odds of the bet selection minus 1, P = the probability of winning and Q = the probability of losing (P minus 1).

Similarly to other tools like a Poisson distribution calculator, the Kelly calculator uses long-established math theory to provide stat-backed support for your betting strategy.

5. What are the Benefits of using a Kelly Criterion Calculator?

A Kelly Criterion Calculator can offer a range of benefits when used properly by bettors. Here are five of the most powerful:

- Minimize risk: By calculating optimal bet sizes based on bankroll and probability of winning, the Kelly Criterion reduces the risk of large losses as a result of bettor bias or miscalculations.

- Maximize Long-Term Profits: By allocating bets proportionally to bettor edge, the Kelly Criterion aims to maximize the growth rate of capital over the long term, leading to higher overall profits.

- Bankroll Management: Providing a systematic approach to bankroll management, it can help size bets to withstand losing streaks and capitalize on winning streaks (though, as with the last two points, it should always be thoroughly tested and evaluated for this purpose).

- Use Alongside Other Calculators: It can be used with other betting tools to form a more well-rounded investment strategy. Examples include an EV calculator (for bet profitability), a free bet converter (for maximizing free bets) and a no-vig fair odds calculator (for finding fair odds).

- Applies to Different Betting Markets: It can also be applied to a range of other betting markets outside of sports betting such as casino markets, where it's commonly used in blackjack.

- Not Limited to Betting: Whilst not a sports betting benefit, it's too important to miss out. Kelly's Criterion doesn't just apply to betting, but can be (and is) used in investing and trading to plan investment allocations.

Kelly Criterion vs Fixed Staking

| Feature | Kelly Criterion | Fixed Staking |

|---|---|---|

| Stake Amount | Varies based on edge and bankroll | Constant amount per bet (e.g. $10 per bet) |

| Requires Win Probability? | Yes: Relies on accurate personal estimation | No does not depend on estimated edge |

| Bankroll Adaptability | Fully dynamic: Adjusts as bankroll grows or shrinks | None: Same stake whether you win or lose |

| Risk Management | Built-in: Avoids over-betting on weak edges | Risk depends entirely on stake size relative to bankroll |

| Profit Potential | Maximizes long-term growth if applied with discipline | Slower bankroll growth; doesn’t capitalize on known edges |

| Best For | Skilled bettors who can estimate probabilities reasonably well | Beginners, or bettors using simple strategies without edge tracking |

💬

What Our Experts Say

"In long-term betting data I’ve reviewed, disciplined use of Kelly sizing often turns even modest edges into steady bankroll growth, while keeping drawdowns under control. The formula may seem dry, but percentage-based staking is a core principle of sustainable profit."

- Chris Allen, Sports & Matched Betting Expert at ProfitDuel

6. Are There any Limitations to a Kelly Criterion Calculator?

Though a Kelly Calculator can have a wide range of benefits in sports betting, it's important to be fully aware of its limitations. Here are four that should not be missed:

- Relies on Past Wins: The calculator relies on the historical win percentage of the bettor to suggest a stake. There is no guarantee that this win percentage is accurate and will be repeated, making its suggestion potentially problematic.

- Experience Barrier: An understanding of probabilities and betting markets can make a big difference to your application of the Kelly Calculator, making it challenging for beginners.

- Ignores External Factors: Fails to consider external factors such as market conditions or sudden changes, which are rife in sports betting. Therefore its reliability will never be 100%.

- Element of Risk: Despite its risk management principles, the Kelly Criterion doesn't eliminate risk entirely; losses are still possible, especially in unpredictable sports events or volatile markets.

💬

What Our Experts Say

"Most bankroll blow-ups I see share one flaw: inflated win probabilities fed into Kelly. A four-point misread can triple your stake and wipe you out. Audit your edge, use fractional Kelly in streaky periods, and let variance work for you."

- Casey Halpern, Sports Betting Expert at ProfitDuel

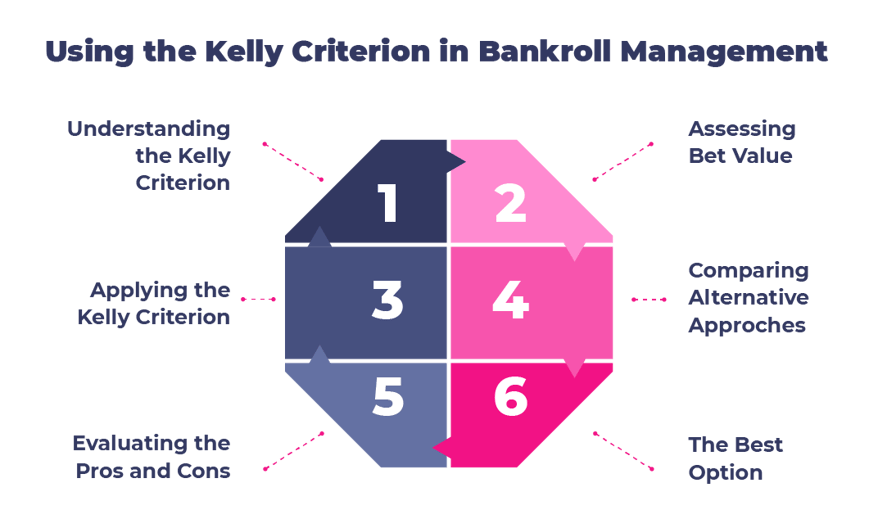

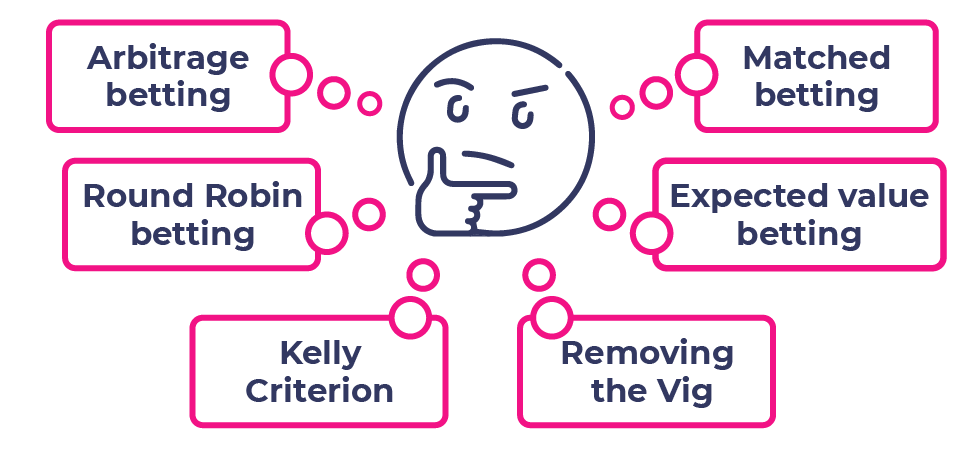

7. How to Maximize Profits by Combining Other Betting Strategies

By this point you'll be aware of the advantages that using the Kelly Criterion can have in sports betting, but you'll also know that no serious sports bettor should rely on it as the sole weapon in their arsenal.

To give yourself the best chance of maximizing profits and minimizing risk, you should include a range of smart betting strategies in your roster.

Opinions on the best vary widely, from arbitrage to expected value to round-robin betting. But the one option that stands above the rest in terms of unlocking returns is matched betting.

Matched betting process (simplified)

Matched betting (in a nutshell) involves covering every outcome of a sporting event to unlock a free bet promotion without risking any of your own cash, then repeating the process using your free bet to lock in a profit, regardless of the result.

It's a promo conversion method that has become rapidly popular among side hustlers and sports bettors across the U.S. and Europe in recent years, with over 500,000 active users in Europe alone. At ProfitDuel we want to help even more Americans to benefit from it.

That's why we're offering a ProfitDuel trial to new members. Here you'll get all of the software, strategies and support you need to start earning today. Heck, we'll even throw in this free guide you can download now to walk you through every step of the process.

FAQs on the Kelly Criterion Calculator

How do I work out my Kelly stake in seconds?

Enter four inputs: bankroll, odds, win probability, and a fractional Kelly multiplier into the calculator. It instantly returns a dollar figure and the % of bankroll to risk.

What’s the safest Kelly multiplier for beginners?

Many sharp bettors start at 0.25–0.5 × Kelly to soften variance while still compounding edge. Moving to full Kelly is best saved for proven, high-confidence models.

Does the Kelly Criterion guarantee profits?

No. It only optimizes stake size for the edge you believe you have. If your win-probability estimate is wrong, Kelly can magnify losses just as quickly as gains.

Can I use Kelly on parlays or accumulators?

Yes, but only after converting parlay odds to true decimal form and reassessing realistic win probability. Parlay edges are usually smaller and variance far higher.

Is the Kelly formula legal to use in US sportsbooks?

Absolutely. Kelly is a money-management technique, not a betting system that manipulates odds, so it’s fully legal in every licensed US market.

How often should I recalculate my Kelly stake?

Update each time your bankroll or win-probability estimate changes; many pros recalculate after every wager so the stake size stays proportional to new balance and data.

What if I don’t know my win probability yet?

Use historical hit rates over at least 50 - 100 similar bets as a baseline, then refine with more data. When in doubt, halve your Kelly stake to reduce estimation risk.

Does Kelly work for live (in-play) betting?

It can, provided you can update win-probability estimates in real time. The faster the market moves, the more value a quick-entry Kelly calculator offers.

How does Kelly compare to flat-unit staking over 1,000 bets?

Simulations show full-Kelly typically yields a higher ending bankroll but experiences deeper drawdowns; flat staking smooths swings but leaves EV on the table.

Can I combine Kelly with matched-betting or arbitrage?

Yes. Use Kelly for value bets where edge is uncertain, and fixed or zero stakes for true arbitrage/matched-bet promos where the outcome is effectively risk-free (provided the processes are correctly followed).

RECOMMENDED CALCULATORS

Would you like to know more or do you have any questions?

Our dedicated support staff are on hand to help you out and keep the profits flowing. Mistakes in the process can happen too and sometimes you might need a bit of advice on what to do.

Our working hours are 8am to 8pm EST, Monday to Sunday.

.png?width=50&height=50&name=download%20(1).png)